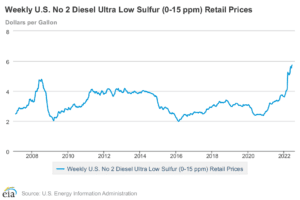

On-Highway diesel Fuel prices are nearly double what they were just two years ago.

What changed?

Freightwaves reported today:

In 2019, the last full pre-pandemic year, [sic] West Texas Intermediate [crude] (WTI) averaged $18.63 a barrel, based on data from the daily settlements of the CME Group Inc. commodity exchange. It regularly dipped below $10 a barrel during the pandemic-gripped market of 2020. At the start of this year, it stood at around $20 a barrel. WTI, in recent days, has hovered just under $60 a barrel, and traders are shaking their heads because they readily admit they have never seen anything like it. Crude is up, but products such as diesel are up a lot further.

Where’s the supply?

Andrew Lipow, an independent refining and markets consultant, noted a long list of non-U.S. refining projects that have been thrown off track, adding to the squeeze in refining capacity

-

-

- The explosion of the Philadelphia Energy Solutions refinery and the decision not to rebuild that plant

- Refineries changing to renewable diesel facilities with reduced output;

- Shell in Martinez, Ca

- Phillips 66 near the San Francisco Bay area

- HFC in Cheyenne, Wy

- The deferral of new projects during the pandemic

-

“As a refinery, are you willing to invest hundreds of millions of dollars [sic] to extend the life of the refinery…in an environment where fossil fuel demand has plateaued and government and state policies have been enacted to reduce demand?” Lipow said

The key numbers to know: According to the Department of Energy (DOE), U.S. refining capacity

-

-

-

- 2010 17.7 million barrels per day

- 2020 just under 20 million barrels per day

- Today 17.9 million barrels per day

-

-

U.S. consumption during that period rose to about 20.5 million barrels per day from about 18.6 million [a net negative 1.9 million barrels per day].

Summary/Commentary

In a market where the carrier has no option for less expensive costs, their choices are very limited. Charge more or don’t move the truck. Obviously not moving the truck is not much of an option as the bank or leasing company doesn’t care what the market it like, the carrier has a payment to make next month and they will get it or the truck will find a new owner. Contract rates are generally 3-4 months behind the spot market but fuel surcharges built into those rates have nearly doubled the price of “fixed” transportation costs pushing shippers into the spot market for relief. With demand waning, prices on the spot market should be declining but with fuel at $6 per gallon, there doesn’t seem to be much relief for shippers while at the same time straining the purse strings of carriers large and small.